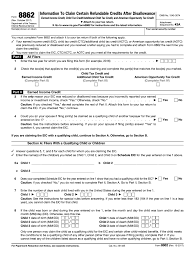

IRS Tax Form 8862

IRS Tax Form Instructions

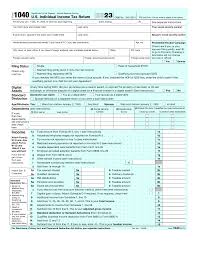

Printable IRS Tax Forms

The Internal Revenue Service (IRS) has released the new Tax Form 8862 and instructions for the 2023 and 2024 tax years.

TRAVERSE CITY, MI, US, January 13, 2024 /EINPresswire.com/ — The Internal Revenue Service (IRS) has released the new Tax Form 8862 and instructions for the 2023 and 2024 tax years.

This form is used to claim the Earned Income Tax Credit (EITC), which is a refundable tax credit for low to moderate-income working individuals and families.

The new form and instructions provide updated guidance on how to claim the EITC and eligibility requirements for the credit. Taxpayers are encouraged to review the instructions carefully before completing the form to ensure they are eligible for the credit.

One of the key highlights of the new form is that taxpayers are required to include their qualifying children’s social security numbers (SSNs) on the form. This is to help prevent fraudulent claims for the EITC and ensure that only eligible taxpayers receive the credit.

In addition, the new form includes specific questions to determine if a taxpayer has been denied the EITC in a prior year and is now eligible to claim the credit. This is important because taxpayers who have been denied the credit in a prior year may still be eligible to claim it in the current year.

The instructions also provide guidance on how to calculate the amount of the credit and how to claim the credit on a tax return. Taxpayers who are eligible for the EITC can claim the credit on their tax return even if they do not owe any taxes.

The release of the new form and instructions is part of the IRS’s ongoing effort to improve tax compliance and prevent fraudulent claims for tax credits. Taxpayers are reminded to keep accurate records and report all income and deductions on their tax returns to avoid penalties and interest charges.

In conclusion, the release of the new IRS Tax Form 8862 and instructions for 2023 and 2024 provides updated guidance on how to claim the Earned Income Tax Credit. Taxpayers are encouraged to review the instructions carefully and ensure they are eligible for the credit before completing the form.

By following the instructions and accurately reporting their income and deductions, taxpayers can avoid penalties and interest charges and claim the credit they are entitled to receive. To access Form 8862 and instructions, visit https://filemytaxesonline.org/printable-irs-tax-forms-instructions/

Frank Ellis

Harbor Financial

email us here

Visit us on social media:

LinkedIn

![]()

Originally published at https://www.einpresswire.com/article/681082537/new-irs-tax-form-8862-and-instructions-for-2023-and-2024-announced-by-harbor-financial